Wake County Property Tax Rate 2024 Lookup By Name – Homeowners in multiple towns across Wake County could see their property rate for the 2024-25 fiscal budget until this summer when the budget process is complete. Based on a revenue-neutral . If you’ve got sticker shock after seeing your new Wake County property tax values, there are ways you can challenge the figures. Residential properties rose an average of 53% in tax value from the .

Wake County Property Tax Rate 2024 Lookup By Name

Source : www.wake.gov

Wake County revaluation results: home, commercial values soar

Source : www.newsobserver.com

Fiscal Year 2024 Adopted Budget | Wake County Government

Source : www.wake.gov

Real Estate | Wake County Government

Source : www.wake.gov

Revenue Neutral Tax Rate | Wake County Government

Source : www.wake.gov

Appeals: Informal Review and Formal Appeal | Wake County Government

Source : www.wake.gov

Board of Commissioners | Wake County Government

Source : www.wake.gov

Think your new Wake County property tax values are too high

Source : news.yahoo.com

Departments & Government | Wake County Government

Source : www.wake.gov

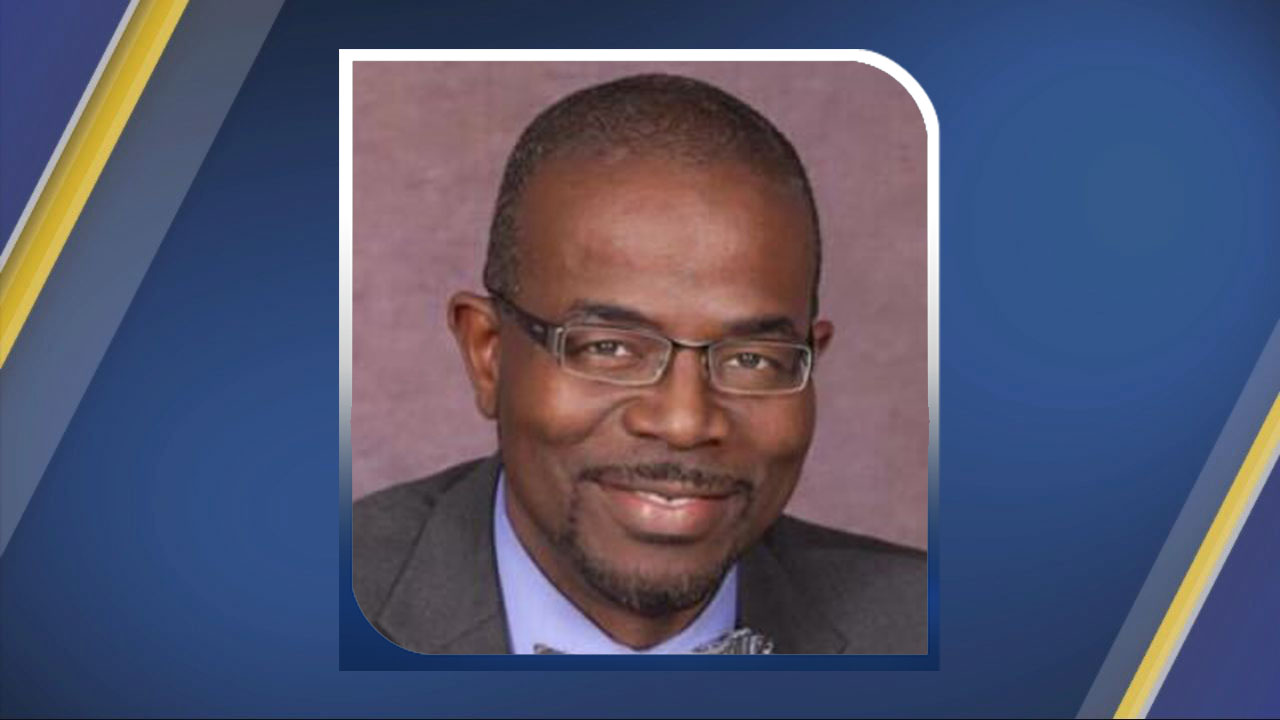

Wake County Public Schools | Wake County School Board names Dr

Source : abc11.com

Wake County Property Tax Rate 2024 Lookup By Name New property value notices to hit Wake County mailboxes starting : While it’s very likely Wake County with a $1,176 property tax In 2024, it would be worth $300,000 with a $1,393 property tax In the same time, because of the lowering tax rate, tax bills . Home values across Wake County have shot up in the past four years, according to newly released results of the county’s 2024 revaluation will set new property tax rates later this year. .